Printable Business Purchase and Sale Agreement Form

Business Purchase and Sale Agreement - Usage Guidelines

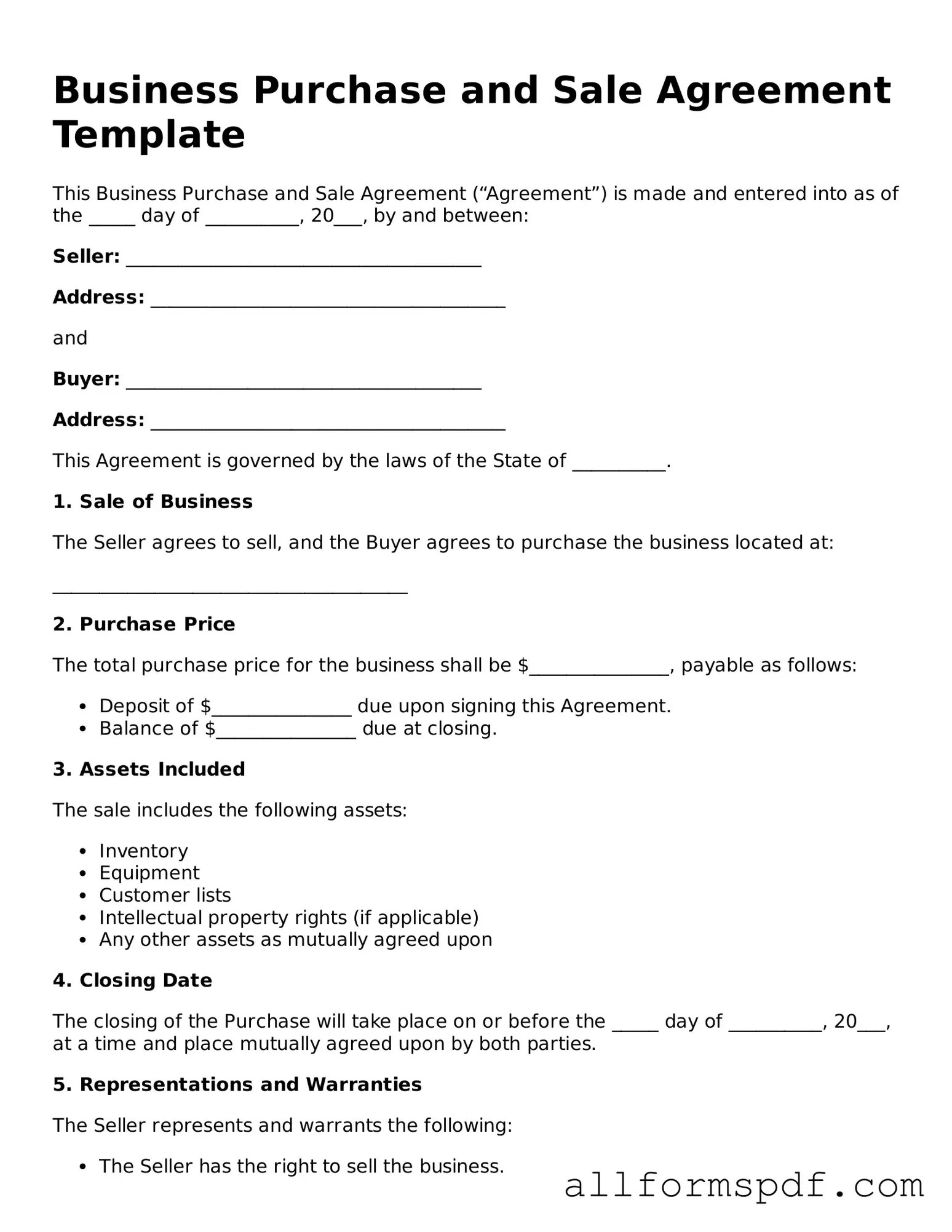

Filling out a Business Purchase and Sale Agreement form is a crucial step in the process of transferring ownership of a business. This document outlines the terms and conditions agreed upon by both the buyer and the seller. It is important to ensure that all information is accurate and complete to avoid misunderstandings later on.

- Begin by entering the date at the top of the form. This is the date when the agreement is being executed.

- Identify the parties involved in the transaction. Clearly state the full legal names of both the buyer and the seller.

- Provide the business name and its legal structure (e.g., LLC, Corporation) in the designated section.

- Detail the purchase price. Clearly specify the total amount the buyer will pay for the business.

- Outline the payment terms. Indicate whether the payment will be made in full upfront or if there will be installments.

- Include a description of the assets being sold. List all tangible and intangible assets that are part of the sale, such as equipment, inventory, and intellectual property.

- Specify any liabilities that the buyer will assume as part of the purchase. This could include debts or obligations of the business.

- Indicate any contingencies that must be met for the sale to proceed, such as financing approval or inspections.

- Include the closing date, which is when the transaction will officially take place.

- Provide spaces for both parties to sign and date the agreement, indicating their acceptance of the terms outlined in the document.

Misconceptions

Understanding the Business Purchase and Sale Agreement (BPSA) is crucial for anyone involved in buying or selling a business. However, several misconceptions can lead to confusion. Here’s a list of nine common misconceptions about this important document:

- It is a standard form that can be used for any business transaction. Each business deal is unique, and the BPSA should be tailored to fit the specific terms and conditions of the transaction.

- Only lawyers can draft a Business Purchase and Sale Agreement. While legal advice is beneficial, business owners can draft the agreement themselves, provided they understand the essential elements involved.

- The BPSA is only necessary for large transactions. Even small business sales can benefit from a formal agreement to clarify terms and protect both parties.

- Once signed, the BPSA cannot be changed. Amendments can be made if both parties agree, but these changes should be documented in writing.

- The BPSA covers all aspects of the sale. While it addresses many key areas, additional agreements may be necessary to cover specific details like non-compete clauses or employment contracts.

- Signing the BPSA means the sale is final. The agreement often includes contingencies that must be satisfied before the sale can be completed.

- It is only important for the seller. The BPSA protects the interests of both the buyer and the seller, ensuring that all parties are clear on their rights and obligations.

- The BPSA does not need to be notarized. While notarization is not always required, having a notarized document can provide an extra layer of authenticity and protection.

- Once the BPSA is signed, there is no room for negotiation. Negotiation can continue even after signing, especially if unforeseen issues arise during the due diligence process.

By addressing these misconceptions, both buyers and sellers can approach the Business Purchase and Sale Agreement with a clearer understanding, ultimately leading to a smoother transaction.

Dos and Don'ts

When filling out the Business Purchase and Sale Agreement form, there are important guidelines to follow. Here are some dos and don’ts to keep in mind:

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information.

- Do seek clarification on any section that is unclear.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank.

- Don't make assumptions; verify facts and figures as needed.

- Don't forget to sign and date the agreement where indicated.

Popular Documents

Storage Lease Agreement Template - Information on inspection rights of the facility is included.

For those looking to understand the intricacies of the ownership transfer process, this informative guide on the necessary General Bill of Sale documentation is invaluable. It provides clarity on not just what the form entails, but also its importance in ensuring a smooth transaction between parties.

Printable Return to Work Doctors Note - Submit this form to outline your job responsibilities during release.

Common mistakes

When completing the Business Purchase and Sale Agreement form, many individuals encounter common pitfalls that can lead to complications later on. One frequent mistake is failing to provide accurate information about the parties involved. This includes not only names but also addresses and contact details. Inaccurate information can cause confusion and may delay the transaction.

Another mistake is overlooking the importance of clearly defining the terms of the sale. Buyers and sellers sometimes assume that certain terms are understood without being explicitly stated. This can lead to misunderstandings regarding payment terms, timelines, and other critical aspects of the agreement.

Many people also neglect to include all necessary attachments or exhibits. These documents may include financial statements, inventory lists, or other relevant materials. Omitting these can result in a lack of clarity about what is being sold and can create issues during the closing process.

Additionally, individuals may fail to address contingencies in the agreement. Contingencies are conditions that must be met for the sale to proceed. Without clearly outlined contingencies, parties may find themselves in a difficult situation if unexpected issues arise.

Another common error is not seeking legal advice or guidance when needed. While it may seem straightforward, the nuances of a business sale can be complex. Skipping this step can lead to oversight of important legal considerations that could affect the transaction.

Lastly, some people do not take the time to review the completed form thoroughly before submission. Errors or omissions can easily go unnoticed, which can lead to delays or disputes down the line. A careful review can help catch mistakes and ensure that all necessary information is included.

Key takeaways

When filling out and using a Business Purchase and Sale Agreement form, several key considerations can help ensure a smooth transaction. Here are ten important takeaways:

- Understand the Purpose: This agreement outlines the terms under which a business is sold, including the rights and obligations of both the buyer and the seller.

- Identify the Parties: Clearly state the names and addresses of both the buyer and the seller. Accurate identification is crucial for legal clarity.

- Describe the Business: Provide a detailed description of the business being sold. This includes its assets, liabilities, and any relevant operational details.

- Purchase Price: Clearly specify the total purchase price and the payment terms. This might include a down payment, installment payments, or other arrangements.

- Contingencies: Include any conditions that must be met for the sale to proceed. This could involve financing, inspections, or regulatory approvals.

- Representations and Warranties: Both parties should make certain promises about the business. These assurances can protect against future disputes.

- Closing Date: Define the timeline for the closing of the sale. This is the date when ownership officially transfers from the seller to the buyer.

- Confidentiality: Consider including a confidentiality clause to protect sensitive business information during and after the sale process.

- Dispute Resolution: Outline how disputes will be resolved, whether through mediation, arbitration, or litigation. This can save time and resources in the event of a disagreement.

- Legal Review: Before finalizing the agreement, have it reviewed by a legal professional. This ensures that all terms are enforceable and compliant with applicable laws.

By keeping these takeaways in mind, both buyers and sellers can navigate the complexities of a business sale more effectively.