Fill Out Your Business Credit Application Form

Business Credit Application - Usage Guidelines

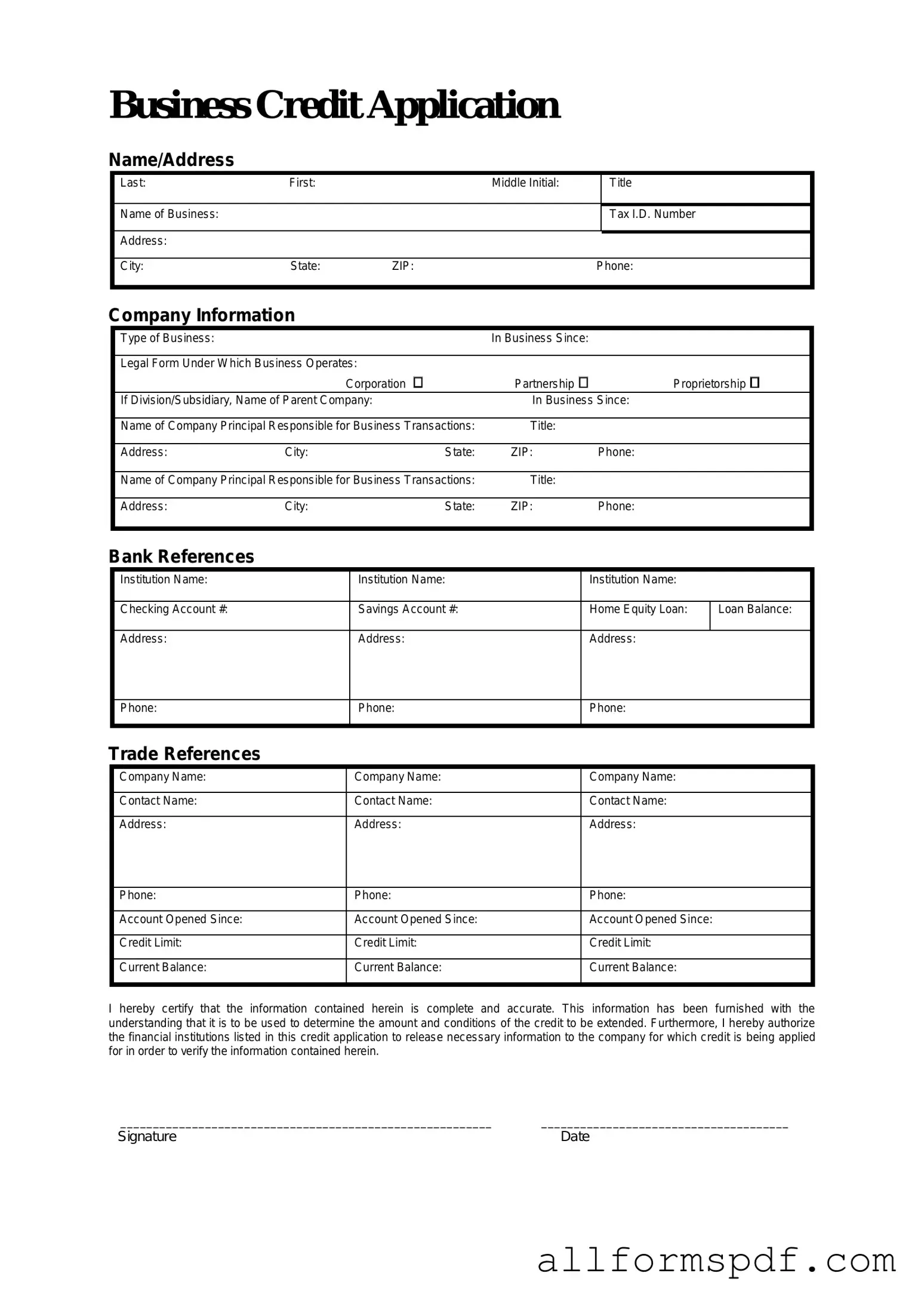

Once you have the Business Credit Application form ready, it's time to fill it out accurately. Completing this form is essential for establishing your business's credit profile. Follow these steps carefully to ensure all required information is provided.

- Begin with the business name. Write the full legal name of your business as registered.

- Provide the business address. Include street, city, state, and ZIP code.

- Fill in the contact information. This should include a phone number and email address.

- Indicate the type of business. Specify if it’s a corporation, partnership, sole proprietorship, etc.

- List the owner(s) or principal(s) of the business. Include their names and titles.

- Enter the business tax identification number. This is often the Employer Identification Number (EIN).

- Provide the years in business. Mention how long the business has been operating.

- Detail the banking information. Include the name of your bank and account type.

- Fill in the credit references. List at least two suppliers or vendors who can verify your creditworthiness.

- Sign and date the form. Ensure that the signature is from an authorized individual.

After completing the form, review it for accuracy. Any missing or incorrect information may delay the processing of your application. Submit the form as instructed, and keep a copy for your records.

Misconceptions

Many business owners encounter the Business Credit Application form, yet several misconceptions can lead to confusion. Understanding these misconceptions is essential for a smoother application process.

- Misconception 1: The form is only for large businesses.

- Misconception 2: Completing the form guarantees credit approval.

- Misconception 3: Only personal credit history matters.

- Misconception 4: The form is too complicated to fill out.

- Misconception 5: Submitting the form is the final step.

This is not true. The Business Credit Application form is available for businesses of all sizes. Small businesses can also benefit from establishing credit, which can help them grow and secure better financing options.

Filling out the application does not automatically mean that credit will be granted. Lenders will review the application, considering various factors, such as credit history and financial stability, before making a decision.

While personal credit history can play a role, business credit history is often more significant. Lenders evaluate both personal and business credit profiles to assess the overall creditworthiness of the applicant.

Though the form may seem daunting at first, it is designed to collect essential information. With careful attention and a clear understanding of the required details, most applicants can complete it without significant difficulty.

Submitting the Business Credit Application is just the beginning. After submission, applicants may need to provide additional documentation or clarification. Staying engaged with the lender throughout the process is crucial for a successful outcome.

Dos and Don'ts

When filling out a Business Credit Application form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do provide accurate and complete information. Double-check all entries to avoid any discrepancies.

- Do include all necessary documentation. This may include financial statements, tax returns, and identification.

- Do be honest about your business's financial status. Transparency can build trust with lenders.

- Do read the entire application carefully before submission. Ensure you understand all terms and conditions.

- Do follow up with the lender after submitting the application. This shows your commitment and may expedite the process.

- Don't rush through the application. Taking your time can prevent mistakes that could delay approval.

- Don't omit any required fields. Leaving sections blank may lead to rejection or delays.

- Don't provide misleading information. Misrepresentation can have serious legal consequences.

- Don't ignore the lender's specific requirements. Each lender may have unique criteria that must be met.

- Don't forget to keep a copy of the completed application for your records. This can be useful for future reference.

Other PDF Forms

Where Can I Find My Pay Stubs on Adp - The pay stub often includes a section for voluntary deductions, like charitable donations.

To begin managing your finances effectively, it is essential to understand the ADP Pay Stub form, which contains vital information about your earnings, taxes, and deductions. For those looking to streamline this process, you can easily access the necessary resources to help you get started. Ready to fill out your form? You can Fill PDF Forms to ensure everything is completed accurately.

Dl44 Pdf - Specific documents may be required based on the applicant's status.

Common mistakes

Filling out a Business Credit Application form can be a straightforward process, but many people make mistakes that can lead to delays or even denials. One common error is providing inaccurate information. This might include misspelling names, entering wrong addresses, or misreporting financial figures. Even a small typo can raise red flags for lenders, leading them to question the reliability of the application.

Another frequent mistake is failing to include all necessary documentation. Lenders typically require specific documents to verify the information provided. This may include tax returns, bank statements, or business licenses. If these documents are missing or incomplete, it can slow down the approval process significantly. Always double-check the requirements before submitting the application.

Many applicants also overlook the importance of a clear business purpose. When filling out the application, it’s crucial to articulate why credit is needed and how it will be used. Lenders want to understand the purpose behind the request. A vague explanation can lead to doubts about the applicant’s intentions and financial planning.

Lastly, some individuals fail to review their application before submission. This step is vital. Taking the time to read through the entire form can help catch errors and ensure that all information is accurate and complete. Submitting an application without a thorough review can result in unnecessary complications down the line.

Key takeaways

Filling out a Business Credit Application form is an important step for any business seeking credit. Here are some key takeaways to keep in mind:

- Accuracy is crucial. Ensure all information is correct. Errors can delay the approval process.

- Provide complete information. Include all requested details about your business, including ownership and financials.

- Be transparent about your business history. Disclose any previous credit issues or bankruptcies honestly.

- Know your credit score. A good credit score can improve your chances of approval and favorable terms.

- Gather supporting documents. Be prepared to provide financial statements, tax returns, and other relevant documents.

- Understand the terms. Review the credit terms and conditions carefully before submitting the application.

- Follow up after submission. Contact the lender if you do not receive a response within a reasonable time frame.

- Keep copies of everything. Maintain a record of your application and any correspondence for future reference.

These steps can help streamline the application process and increase your chances of obtaining the credit your business needs.