Printable Business Bill of Sale Form

Business Bill of Sale - Usage Guidelines

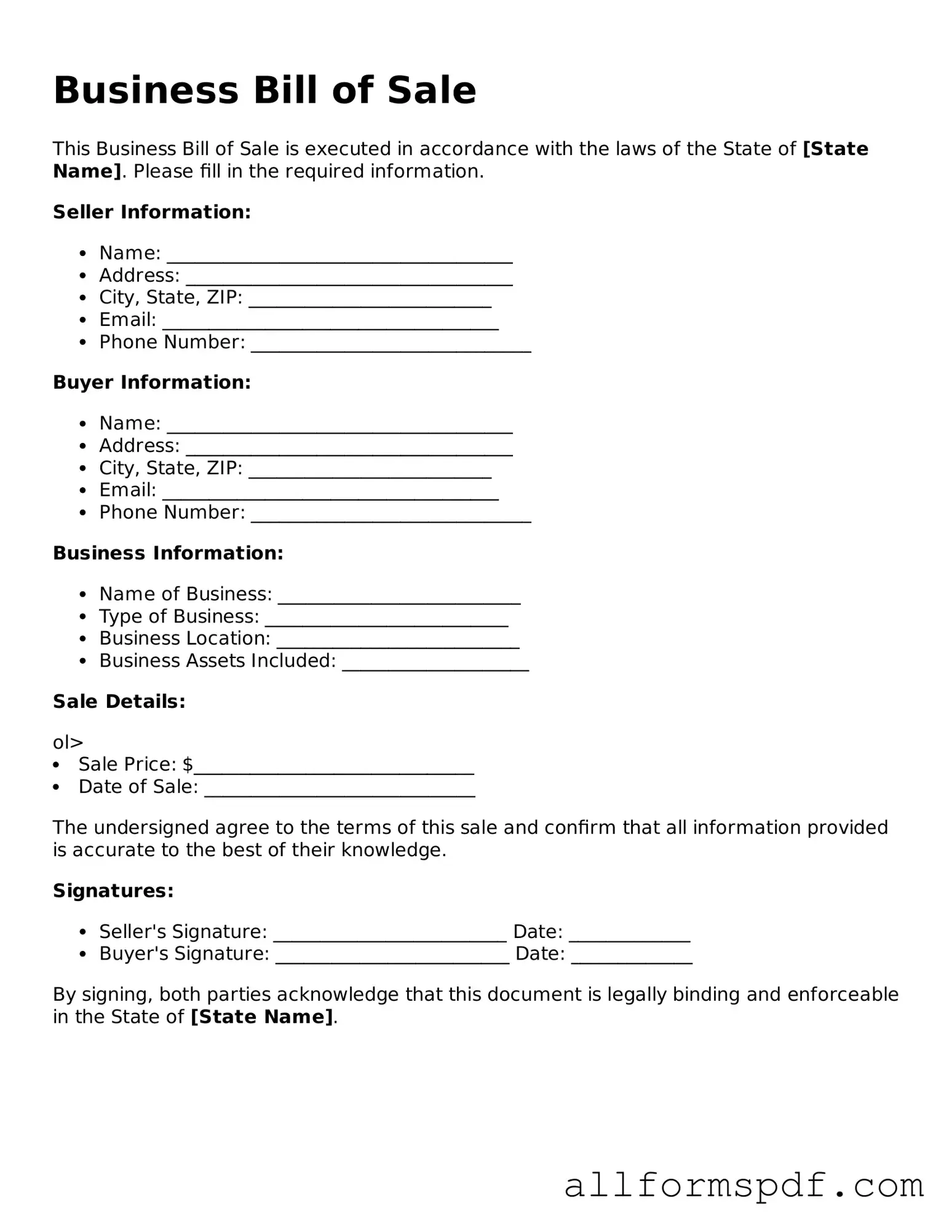

Filling out the Business Bill of Sale form is an important step in transferring ownership of a business. This document serves as proof of the transaction and outlines the details of the sale. Follow these steps carefully to ensure that all necessary information is included and accurately represented.

- Obtain the form: Download or print the Business Bill of Sale form from a reliable source.

- Enter the date: Write the date of the sale at the top of the form.

- Seller's information: Fill in the full name, address, and contact information of the seller.

- Buyer's information: Provide the full name, address, and contact information of the buyer.

- Business details: Describe the business being sold, including its name and any relevant identification numbers.

- Sale price: Clearly state the total sale price of the business.

- Payment terms: Specify how payment will be made, whether in full or through installments.

- Signatures: Both the seller and buyer must sign the document to validate the transaction.

- Date of signatures: Include the date when each party signs the form.

After completing these steps, review the form for accuracy. Ensure that all information is clear and legible. Once confirmed, make copies for both parties and retain them for your records.

Misconceptions

The Business Bill of Sale form is often misunderstood. Below are nine common misconceptions, along with clarifications to help you better understand this important document.

-

It is only necessary for large transactions.

A Business Bill of Sale is important for any sale, regardless of size. It provides legal protection and clarity for both parties involved.

-

It does not need to be signed by both parties.

For the document to be legally binding, it must be signed by both the seller and the buyer. This ensures that both parties agree to the terms of the sale.

-

Oral agreements are sufficient.

While oral agreements may seem convenient, they can lead to misunderstandings. A written Bill of Sale serves as a clear record of the transaction.

-

It is only for tangible assets.

The form can be used for both tangible and intangible assets, such as business licenses or intellectual property. It provides a comprehensive record of the sale.

-

Once signed, it cannot be changed.

While the document is legally binding, amendments can be made if both parties agree. It is advisable to document any changes in writing.

-

It is not required by law.

While specific laws may vary by state, having a Bill of Sale is highly recommended. It can protect against future disputes and provide proof of ownership.

-

It is the same as a purchase agreement.

Though related, a Bill of Sale is different from a purchase agreement. The former finalizes the sale, while the latter outlines the terms before the sale is completed.

-

All sales are final with no recourse.

A Bill of Sale can include terms regarding warranties or returns. This means that buyers may have recourse if the product does not meet the agreed-upon conditions.

-

It is only for private sales.

Businesses can also use a Bill of Sale when selling to other businesses or entities. It is a versatile tool for all types of transactions.

Understanding these misconceptions can help ensure that your business transactions are conducted smoothly and legally. Always consider consulting with a legal professional for specific advice related to your situation.

Dos and Don'ts

When filling out a Business Bill of Sale form, it is crucial to ensure accuracy and compliance. Here are ten important dos and don'ts to keep in mind:

- Do provide accurate information about the buyer and seller, including full names and contact details.

- Do clearly describe the business being sold, including its name, location, and any relevant identification numbers.

- Do specify the purchase price and payment terms in detail to avoid confusion later.

- Do include the date of the transaction to establish a clear timeline.

- Do have both parties sign the document to validate the agreement.

- Don't leave any sections blank; incomplete forms can lead to disputes.

- Don't use vague language; be specific about what is included in the sale.

- Don't forget to keep a copy of the signed form for your records.

- Don't rush through the process; take the time to review the document thoroughly.

- Don't ignore local laws or regulations that may affect the sale; consult with a professional if necessary.

Following these guidelines will help ensure a smooth transaction and protect the interests of both parties involved.

Discover More Types of Business Bill of Sale Documents

Bill of Sale Para Imprimir - It can be a straightforward tool for casual sales between individuals.

Mobile Home Bill of Sale - Completing this document accurately can prevent future complications in ownership disputes.

For those looking to simplify their transactions, the "user-friendly General Bill of Sale" is an invaluable document. It ensures that both parties have a clear record of ownership transfer, which is essential for future reference and legal protection. You can access more information about this important form at user-friendly General Bill of Sale.

How to Write Bill of Sale for Boat - It is wise to complete a Boat Bill of Sale before payment is finalized.

Common mistakes

When completing a Business Bill of Sale form, individuals often overlook critical details that can lead to complications down the line. One common mistake is failing to include accurate information about the parties involved in the transaction. This includes the names, addresses, and contact information of both the buyer and the seller. Incomplete or incorrect details can result in disputes or difficulties in enforcing the terms of the sale.

Another frequent error is neglecting to specify the terms of the sale clearly. Buyers and sellers may assume that certain conditions are understood, but it is essential to outline all terms explicitly. This includes payment methods, any warranties or guarantees, and what exactly is being sold. Without this clarity, misunderstandings can arise, potentially leading to legal issues.

People also often forget to document the sale date on the form. While it may seem trivial, the date is crucial for establishing the timeline of the transaction. This information can be vital in case of disputes or if there are questions regarding the ownership of the business assets. Omitting the date can create confusion and complicate matters further.

Lastly, many individuals fail to have the form properly signed by both parties. A Business Bill of Sale is only valid when it includes the signatures of both the buyer and the seller. This step is not just a formality; it serves as a legal acknowledgment of the agreement. Without these signatures, the document may not hold up in court if a disagreement arises.

Key takeaways

When filling out and using a Business Bill of Sale form, keep these key points in mind:

- Accurate Information: Ensure all details about the buyer and seller are correct. This includes names, addresses, and contact information.

- Clear Description: Provide a detailed description of the business being sold, including any assets, inventory, and equipment involved.

- Purchase Price: Clearly state the total purchase price of the business. This helps avoid misunderstandings later.

- Payment Terms: Specify how the payment will be made—whether it’s a lump sum or installments. This sets clear expectations.

- Signatures Required: Both the buyer and seller must sign the document. This validates the agreement and makes it legally binding.

- Witness or Notary: Consider having a witness or notary public present during the signing. This adds an extra layer of credibility.

- Keep Copies: Make sure both parties retain a copy of the signed Bill of Sale for their records. This is important for future reference.

- Consult Professionals: If unsure about any part of the process, consult with a legal or financial professional. Their guidance can be invaluable.

- State Requirements: Check if your state has specific requirements for a Bill of Sale. Compliance with local laws is crucial.