Fill Out Your Broker Price Opinion Form

Broker Price Opinion - Usage Guidelines

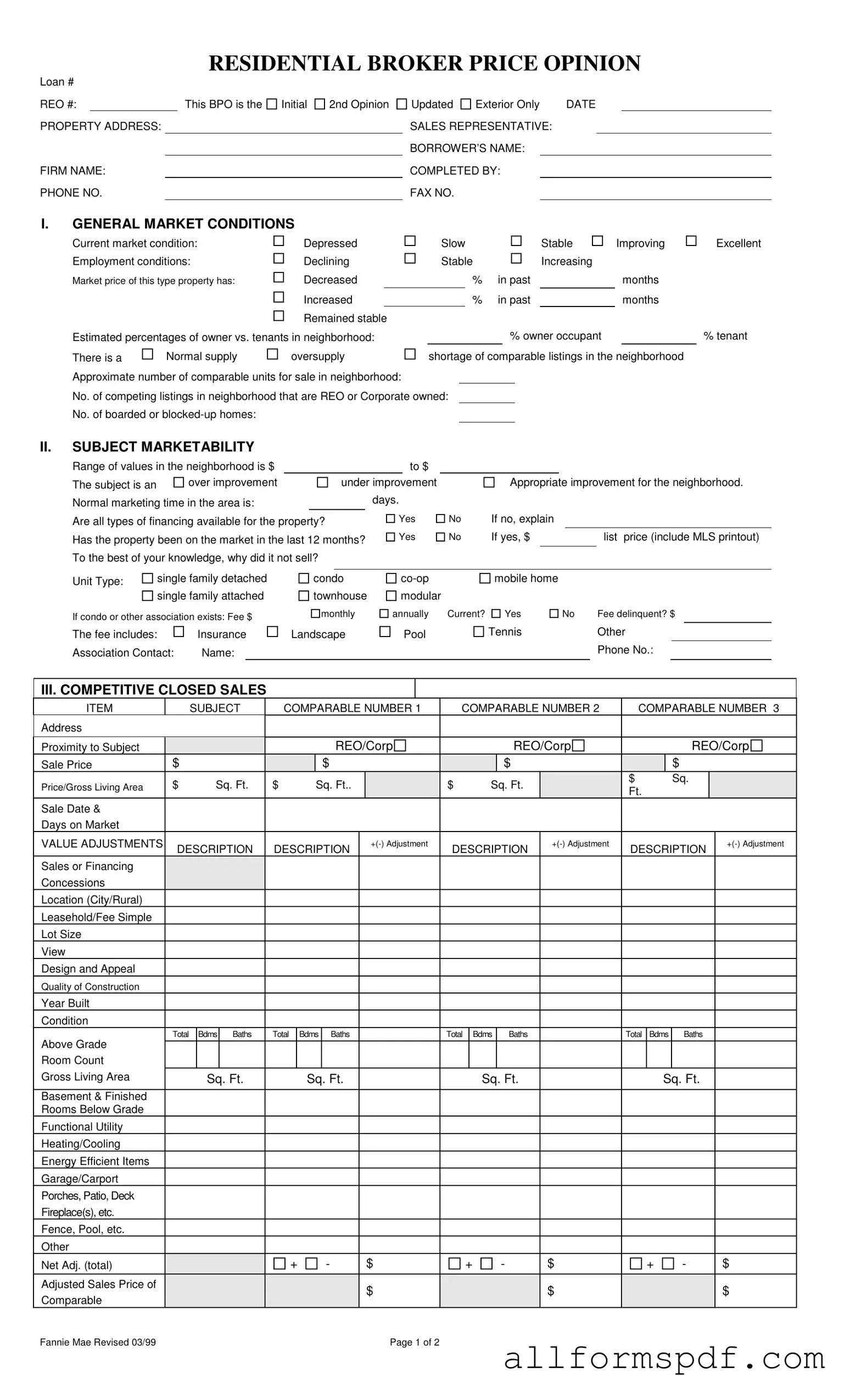

Filling out the Broker Price Opinion (BPO) form requires attention to detail and accurate information. This form is essential for evaluating a property's market value based on various factors, including current market conditions and comparable sales. Follow these steps to complete the form effectively.

- Begin by entering the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS, FIRM NAME, and PHONE NO..

- Select the appropriate option for Initial, 2nd Opinion, or Updated.

- Provide the DATE and the name of the SALES REPRESENTATIVE.

- Enter the BORROWER’S NAME and the name of the person COMPLETED BY.

- Include the FAX NO. for communication purposes.

- In the GENERAL MARKET CONDITIONS section, indicate the Current market condition and Employment conditions.

- Specify the market price trend for the property type and the estimated percentage of owner vs. tenants in the neighborhood.

- Note the supply of comparable listings and approximate number of comparable units for sale.

- In the SUBJECT MARKETABILITY section, provide the range of values, marketing time, and financing availability.

- Indicate whether the property has been on the market in the last 12 months and provide the list price if applicable.

- Specify the Unit Type and any applicable association fees, including details about current status and contact information.

- For the COMPETITIVE CLOSED SALES section, fill in details for up to three comparable properties, including addresses, sale prices, and adjustments.

- In the MARKETING STRATEGY section, select the appropriate option for the property's condition.

- Document the REPAIRS needed, including occupancy status and itemized repair costs.

- In the COMPETITIVE LISTINGS section, provide information about comparable listings, including list prices and adjustments.

- Determine the MARKET VALUE and suggested list price, including quick sale value.

- Finally, add any COMMENTS regarding the property and sign and date the form.

Misconceptions

- Misconception 1: The Broker Price Opinion (BPO) is the same as an appraisal.

- Misconception 2: BPOs are only used for distressed properties.

- Misconception 3: All BPOs follow the same format.

- Misconception 4: A BPO guarantees a specific sale price.

- Misconception 5: BPOs are only for residential properties.

- Misconception 6: The BPO process is quick and requires little effort.

- Misconception 7: A BPO is only useful for lenders.

- Misconception 8: The BPO is solely based on the property’s condition.

- Misconception 9: A BPO can be completed without visiting the property.

The BPO is not a formal appraisal. It is an opinion of value based on market analysis, while an appraisal is a detailed assessment conducted by a licensed appraiser.

BPOs can be used for various types of properties, not just distressed ones. They are commonly utilized in sales, refinancing, and market analysis.

BPOs can vary in format and content based on the requirements of the lender or company requesting them. Each BPO may emphasize different aspects of the property.

A BPO provides an estimated value but does not guarantee that the property will sell at that price. Market conditions and buyer interest can affect the final sale price.

BPOs can be conducted for both residential and commercial properties. The principles of market analysis apply to various types of real estate.

While BPOs can be completed faster than appraisals, they still require thorough research and analysis of the property and comparable sales.

BPOs are beneficial for sellers, buyers, and real estate agents as well. They provide valuable insights into property value and market conditions.

The BPO considers multiple factors, including market trends, comparable sales, and neighborhood conditions, in addition to the property's physical state.

While exterior-only BPOs exist, a thorough assessment usually requires an interior inspection to accurately gauge the property's condition and features.

Dos and Don'ts

When filling out the Broker Price Opinion form, it is essential to follow certain guidelines to ensure accuracy and clarity. Below is a list of things you should and shouldn't do:

- Do provide accurate property details, including the address and loan number.

- Do assess the current market conditions thoroughly before making any evaluations.

- Do include all relevant comparable sales and listings to support your opinion.

- Do be clear and concise in your comments, highlighting both positives and negatives.

- Don't leave sections blank; ensure every part of the form is completed.

- Don't use vague language; be specific in your assessments and recommendations.

- Don't ignore the importance of current market trends; they can significantly impact your opinion.

- Don't forget to sign and date the form before submission.

Other PDF Forms

Joint Tenancy in California - The affidavit helps establish the rights of the surviving joint tenant.

The Florida Vehicle POA form 82053 is a legal document that allows someone to appoint another person to handle tasks related to their vehicle on their behalf. This could range from registration and titling to the sale or purchase of the vehicle. It provides a convenient way for vehicle owners to ensure their affairs are managed even when they cannot handle them personally. For more details, you can refer to All Florida Forms.

Da - The form aids in compliance with military property accountability standards.

Tb Skin Testing - A positive result may indicate a past or current TB infection.

Common mistakes

Filling out the Broker Price Opinion (BPO) form accurately is essential for obtaining a reliable valuation of a property. However, there are common mistakes that can lead to inaccurate assessments. Here are nine mistakes to avoid.

First, failing to complete all required fields can significantly hinder the BPO process. Each section of the form is designed to gather specific information about the property and market conditions. Leaving out details like the property address, loan number, or sales representative can create confusion and delay the evaluation.

Second, not providing accurate market conditions is a frequent error. The current state of the market—whether it is depressed, stable, or improving—plays a crucial role in pricing. Misrepresenting these conditions can lead to incorrect pricing recommendations.

Another common mistake is neglecting to assess the appropriate improvement level for the neighborhood. Indicating that a property is an "over improvement" or "under improvement" without proper justification can mislead potential buyers and lenders.

Fourth, many individuals forget to include the estimated percentages of owner-occupants versus tenants in the neighborhood. This information is vital for understanding the market dynamics and can impact the property’s valuation.

Fifth, failing to check the financing options available for the property can be detrimental. If specific financing types are not available, this should be clearly stated. This transparency helps potential buyers make informed decisions.

Sixth, not providing a complete list of comparable properties can lead to an inaccurate assessment. Ensure that the comparable listings include necessary details such as sale prices, days on market, and adjustments made for differences in features.

Seventh, overlooking the importance of itemizing repairs needed to bring the property to marketable condition is a critical mistake. A detailed list of repairs can help in accurately estimating costs and setting a realistic price.

Eighth, not including comments on the property’s unique features or potential concerns can leave out important context. Specific notes about environmental issues, easements, or any special concerns should be documented to provide a comprehensive view.

Finally, failing to sign and date the form can invalidate the submission. A signature confirms the accuracy of the information provided and the date ensures that the assessment is current.

By avoiding these mistakes, individuals can ensure that the Broker Price Opinion form is completed accurately, leading to a more reliable property valuation.

Key takeaways

1. Understand the Purpose: The Broker Price Opinion (BPO) form is used to estimate the market value of a property. This assessment helps lenders and investors make informed decisions.

2. Fill Out Basic Information: Complete all required fields, including loan number, property address, and contact information. Accuracy is essential for effective communication.

3. Assess Market Conditions: Provide a clear evaluation of the current market conditions. Indicate whether they are depressed, stable, or improving. This context is crucial for understanding the property's value.

4. Evaluate Subject Marketability: Analyze the subject property’s marketability. Consider the range of values in the neighborhood and the typical marketing time. This information influences pricing strategies.

5. Compare with Closed Sales: Use comparable sales data to support your valuation. Include details such as sale prices, days on market, and adjustments for differences. This strengthens your opinion.

6. Document Repairs Needed: Clearly itemize any repairs required to make the property marketable. This helps potential buyers understand the investment needed.

7. Analyze Competitive Listings: Review similar properties currently on the market. Compare their list prices and conditions to gauge the competitive landscape.

8. Determine Market Value: The final market value should align with the range indicated by competitive closed sales. Be realistic and support your valuation with data.

9. Provide Comprehensive Comments: Include any specific positives or negatives about the property. Address concerns such as easements or environmental issues. This information is vital for transparency.