Printable Articles of Incorporation Form

State-specific Guidelines for Articles of Incorporation Documents

Articles of Incorporation - Usage Guidelines

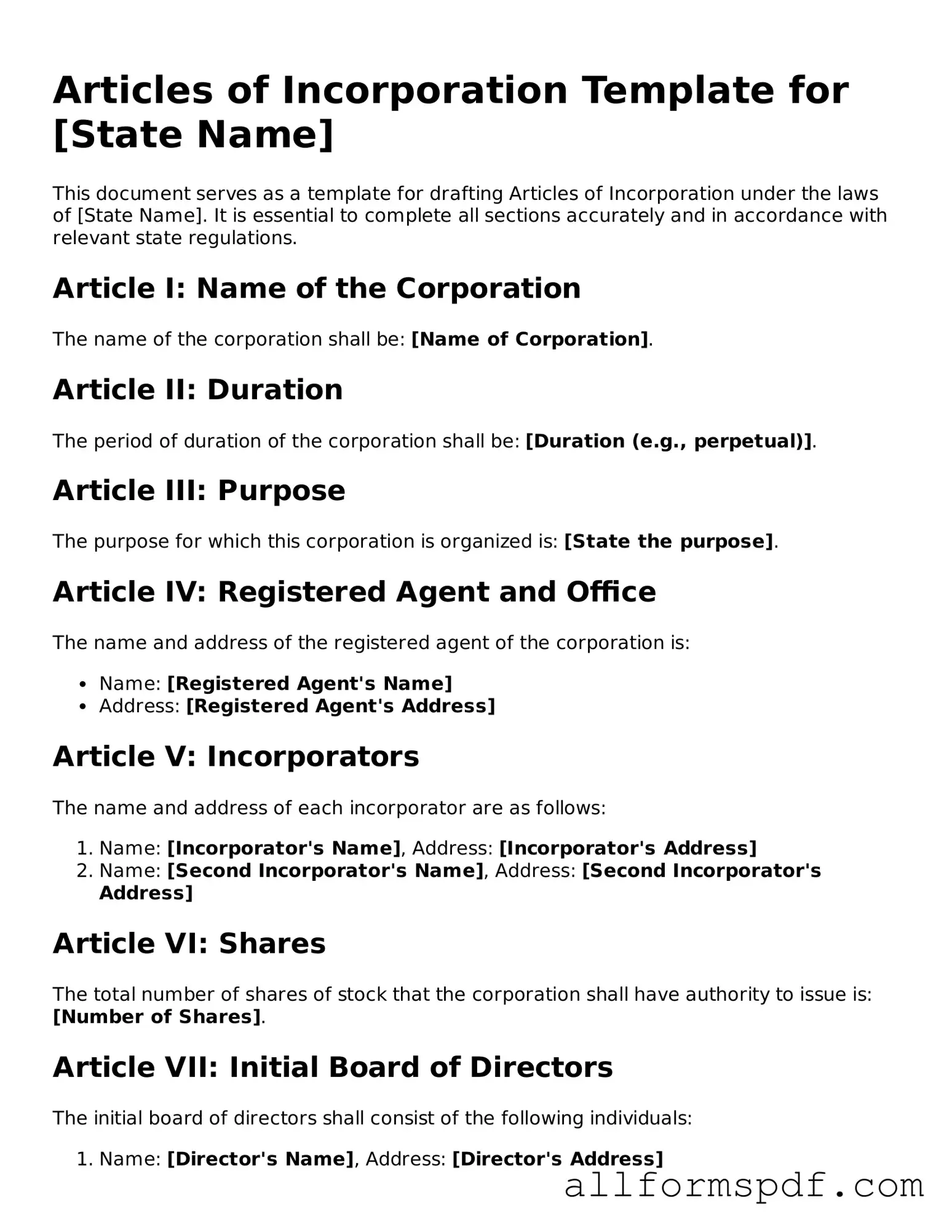

After obtaining the Articles of Incorporation form, you will need to provide specific information about your organization. This document is crucial for formally establishing your corporation in the state. Completing this form accurately is essential to ensure compliance with state regulations.

- Start by providing the name of your corporation. Ensure that it is unique and complies with state naming requirements.

- Indicate the purpose of the corporation. This should be a brief statement outlining the business activities.

- List the address of the corporation's principal office. This should be a physical address, not a P.O. Box.

- Provide the name and address of the registered agent. This individual or business will receive legal documents on behalf of the corporation.

- Include the number of shares the corporation is authorized to issue. Specify the classes of shares if applicable.

- State the duration of the corporation. Most corporations are set up to exist perpetually unless otherwise specified.

- Sign and date the form. Ensure that the person signing has the authority to do so.

- Review the completed form for accuracy. Check for any missing information or errors.

- Submit the form to the appropriate state agency along with any required fees.

Misconceptions

Understanding the Articles of Incorporation is essential for anyone looking to start a corporation. However, several misconceptions often cloud this important document. Here are eight common misunderstandings:

- It's only for large businesses. Many believe that only large corporations need Articles of Incorporation. In reality, any business entity that wishes to incorporate, regardless of size, must file this document.

- It's a one-time requirement. Some think that filing Articles of Incorporation is a one-time task. However, corporations must adhere to ongoing compliance requirements, including annual reports and fees.

- It guarantees business success. Incorporating a business does not ensure success. While it provides legal protections and structure, success depends on various factors, including management and market conditions.

- All states have the same requirements. Many assume that the Articles of Incorporation process is uniform across the U.S. Each state has its own specific requirements and forms, which must be carefully followed.

- It's just a formality. Some view the filing as a mere formality. In fact, it establishes the legal existence of the corporation and outlines its fundamental structure.

- Anyone can file it. While many people can complete the form, certain states require that the filing be done by an attorney or registered agent, depending on local laws.

- It’s the same as a business license. The Articles of Incorporation is not the same as a business license. The former establishes the corporation, while the latter permits the business to operate within a jurisdiction.

- Once filed, it cannot be changed. Some believe that once the Articles are filed, they are set in stone. Amendments can be made to the Articles if changes in the business structure occur, but they must be filed with the state.

By clarifying these misconceptions, individuals can better navigate the process of incorporating their business and ensure compliance with legal requirements.

Dos and Don'ts

When filling out the Articles of Incorporation form, it is important to adhere to certain guidelines to ensure accuracy and compliance. Here are six things to do and not do:

- Do provide accurate information about the corporation's name, ensuring it complies with state regulations.

- Do include the purpose of the corporation clearly and concisely.

- Do list the names and addresses of the initial directors and incorporators.

- Do ensure that the registered agent's name and address are correct.

- Don't use abbreviations or informal language that may cause confusion.

- Don't forget to sign and date the form before submission.

By following these guidelines, you can help ensure that the filing process goes smoothly and that your corporation is established correctly.

Popular Documents

Problems With Transfer on Death Deeds California - Check with your local laws to ensure compliance with the Transfer-on-Death Deed.

Understanding the Florida Sales Tax form is essential for businesses operating in the state, as it helps ensure compliance with tax regulations while accurately reporting sales and tax collected. For more information and resources, you can explore All Florida Forms to access the necessary documentation and guidance.

Roof Inspection Report - Check the membrane or shingles for indications of distress.

Common mistakes

When individuals set out to incorporate a business, they often encounter the Articles of Incorporation form. This document is crucial for establishing a corporation's legal identity. However, errors in its completion can lead to delays or even rejection of the application. Understanding common mistakes can significantly enhance the chances of a successful filing.

One frequent mistake is the omission of essential information. Many people fail to include the corporation's name, which must be unique and comply with state regulations. Without a proper name, the application cannot proceed. Additionally, the purpose of the corporation should be clearly stated. Vague or overly broad descriptions can raise questions during the review process.

Another common error involves the selection of the registered agent. This individual or entity is responsible for receiving legal documents on behalf of the corporation. Some applicants mistakenly list themselves without understanding the implications. A registered agent must be available during business hours and have a physical address in the state of incorporation.

Incorrectly identifying the number of shares authorized for issuance is also a typical mistake. Applicants may either underestimate or overestimate this number. It is important to consider future growth and funding needs. The shares should be clearly defined in terms of class and par value, if applicable.

Inaccurate or incomplete information about the incorporators can lead to complications. Each incorporator's name and address must be provided. Failing to include all required incorporators can result in delays or the rejection of the filing.

Many individuals overlook the importance of signing the document. The Articles of Incorporation must be signed by at least one incorporator. An unsigned document is invalid and will not be processed. Additionally, the date of signing should be included to establish a timeline for the incorporation.

Some applicants neglect to check the specific requirements of their state. Each state has its own regulations regarding the Articles of Incorporation. Failing to adhere to these guidelines can result in rejection or additional fees. Therefore, it is crucial to consult the appropriate state agency before submission.

Another mistake involves submitting the form without the required fees. Each state requires a filing fee that varies significantly. Applicants should ensure that payment is included and that the method of payment is acceptable to the state agency.

Inconsistencies in the information provided can also cause issues. For example, if the name of the corporation differs between sections of the form, it can lead to confusion. Consistency is key in ensuring that the application is processed smoothly.

Lastly, some individuals fail to seek assistance when needed. While the Articles of Incorporation form may seem straightforward, legal and procedural complexities can arise. Consulting with a legal professional or utilizing resources provided by state agencies can help avoid common pitfalls and ensure a successful incorporation process.

Key takeaways

Filling out and using the Articles of Incorporation form is a crucial step in establishing a corporation. Here are some key takeaways to consider:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation, outlining its structure and purpose.

- Choose a Unique Name: Ensure that the name you select for your corporation is not already in use. It must be distinguishable from existing entities registered in your state.

- Specify the Business Address: Provide a physical address for the corporation. This is where official correspondence will be sent.

- Identify the Registered Agent: Designate a registered agent who will receive legal documents on behalf of the corporation. This person or entity must be located in the state of incorporation.

- Outline the Purpose: Clearly state the purpose of your corporation. This can be general or specific, but it should reflect the nature of the business activities.

- Include Share Structure: Define the number of shares the corporation is authorized to issue and the classes of shares, if applicable. This information is vital for future investors and shareholders.

- File with the State: After completing the form, submit it to the appropriate state agency along with any required fees. This step formalizes your corporation’s existence.

By keeping these points in mind, individuals can navigate the process of incorporating a business with greater confidence and clarity.