Fill Out Your Adp Pay Stub Form

Adp Pay Stub - Usage Guidelines

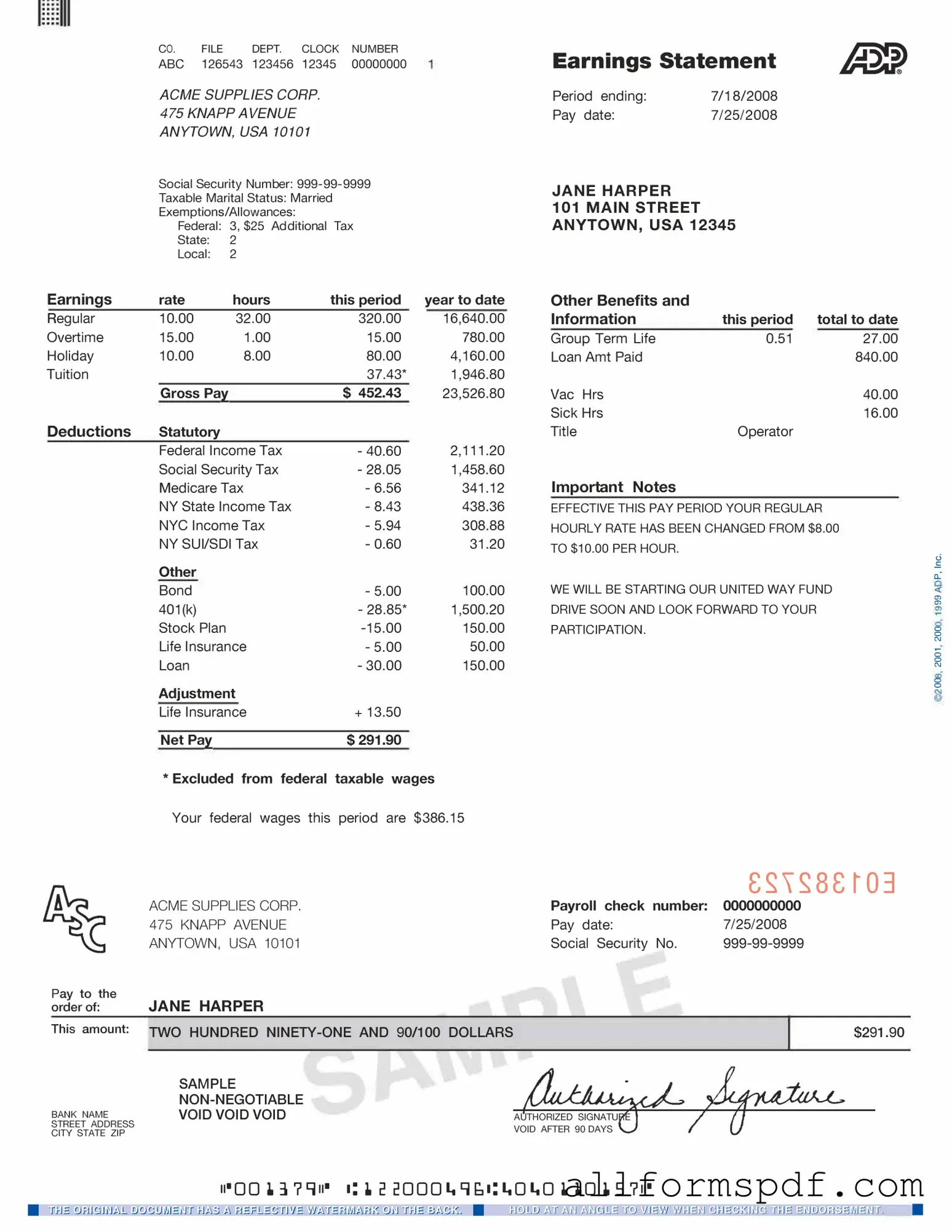

Filling out the ADP Pay Stub form is a straightforward process. Once you have the form in front of you, follow these steps to ensure that you complete it accurately.

- Start with your personal information. Fill in your name, address, and employee ID at the top of the form.

- Next, enter the pay period dates. This indicates the timeframe for which you are being paid.

- In the earnings section, list your total hours worked and your hourly rate or salary. Make sure these numbers are accurate.

- Include any bonuses or overtime pay in the appropriate sections, if applicable.

- Move on to deductions. Fill in any taxes, insurance, or retirement contributions that apply to your paycheck.

- Review the total earnings and total deductions to ensure they add up correctly.

- Finally, sign and date the form at the bottom to confirm that all information is correct.

Misconceptions

-

Misconception 1: The ADP pay stub is only for salaried employees.

This is incorrect. Both hourly and salaried employees receive pay stubs from ADP. The pay stub reflects the earnings for all types of employees.

-

Misconception 2: Pay stubs are only issued for full-time employees.

Part-time employees also receive pay stubs. The frequency and amount may vary, but all employees should have access to their pay information.

-

Misconception 3: The pay stub only shows gross pay.

This is false. The pay stub includes gross pay, deductions, and net pay, providing a complete picture of earnings and withholdings.

-

Misconception 4: Deductions on the pay stub are always the same.

Deductions can change based on various factors, including tax rates, benefits enrollment, and other personal choices. It’s important to review each pay stub for accuracy.

-

Misconception 5: You can only access pay stubs through paper copies.

ADP provides digital access to pay stubs. Employees can view and download their pay stubs online, making it easier to keep records.

-

Misconception 6: Pay stubs are not important for tax purposes.

This is misleading. Pay stubs are essential for tracking earnings and deductions, which are necessary for accurate tax filing.

-

Misconception 7: All information on the pay stub is mandatory.

While many elements are standard, some details may vary by employer or state regulations. Employees should verify what is included based on their specific situation.

Dos and Don'ts

When filling out the ADP Pay Stub form, it’s important to approach the task with care. Here are some helpful tips on what to do and what to avoid:

- Do double-check all personal information for accuracy.

- Do ensure that your pay period dates are correct.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use unclear abbreviations or shorthand.

- Don't forget to sign and date the form before submission.

By following these guidelines, you can help ensure that your ADP Pay Stub form is filled out correctly and efficiently.

Other PDF Forms

How to Become a Professional Cuddler - Connect with others seeking platonic cuddling experiences.

The Asurion F-017-08 MEN form not only facilitates the claims process but also empowers users to navigate their device protection claims with ease. By promptly submitting the required details, users can expedite their requests for assistance. For a seamless experience, you can begin the process by clicking on this link: Fill PDF Forms.

How to Gift a Car in Louisiana - Completing this form is a straightforward way to make a generous contribution.

Common mistakes

Filling out the ADP Pay Stub form can seem straightforward, but many individuals make common mistakes that can lead to confusion or errors in their payroll. One frequent error is not double-checking personal information. Names, addresses, and Social Security numbers must be accurate. A simple typo can create significant issues when processing payroll or filing taxes.

Another mistake is miscalculating hours worked. Employees should ensure that they accurately record all hours, including overtime. Failing to do so can result in underpayment. Always review the total hours before submitting the form.

People often overlook the importance of understanding deductions. Many individuals do not fully grasp how taxes and other deductions affect their net pay. Familiarizing oneself with these deductions can prevent surprises when the paycheck arrives.

Additionally, some individuals forget to include any bonuses or commissions earned during the pay period. These should be clearly listed on the form to ensure proper compensation. Omitting this information can lead to disputes later on.

Another common oversight is not keeping a copy of the completed form. After filling out the ADP Pay Stub form, it is essential to retain a copy for personal records. This can be helpful for future reference or in case of discrepancies.

Many people also fail to update their information when life changes occur. Marital status, dependents, and address changes should be reflected on the form. Neglecting to update this information can lead to incorrect tax withholdings.

Some individuals do not take the time to read the instructions provided with the form. These guidelines are there for a reason. Following them closely can help avoid many common pitfalls.

Another mistake is submitting the form without reviewing it for errors. A final review can catch mistakes that were overlooked during the initial filling process. Taking a moment to check for accuracy can save time and hassle.

Lastly, procrastination can lead to rushed submissions. Filling out the ADP Pay Stub form at the last minute can increase the likelihood of errors. It’s best to complete the form well in advance of the deadline to ensure accuracy.

Key takeaways

When filling out and using the ADP Pay Stub form, it is essential to understand its components and how to utilize the information effectively. Here are five key takeaways:

- Accurate Personal Information: Ensure that all personal details, such as name, address, and Social Security number, are correct. Errors can lead to complications with tax filings and payroll processing.

- Understanding Deductions: Review the deductions section carefully. This part outlines what has been withheld from your paycheck, including taxes, benefits, and retirement contributions.

- Gross vs. Net Pay: Familiarize yourself with the difference between gross pay and net pay. Gross pay is the total earnings before any deductions, while net pay is what you take home after deductions.

- Review Pay Periods: Pay stubs indicate the pay period covered. Knowing the exact dates helps in tracking earnings and managing personal finances more effectively.

- Record Keeping: Keep a copy of your pay stubs for personal records. They are important for tax preparation and can serve as proof of income when applying for loans or other financial services.